Financial Advisor Magazine for Beginners

Wiki Article

Facts About Financial Advisor Job Description Uncovered

Table of ContentsThe Best Strategy To Use For Financial Advisor DefinitionThe Best Guide To Financial AdvisorThe 25-Second Trick For Advisor Financial ServicesThe Greatest Guide To Financial AdvisorFinancial Advisor Fees Can Be Fun For EveryoneNot known Incorrect Statements About Financial Advisor Magazine The smart Trick of Financial Advisor Fees That Nobody is DiscussingThe Basic Principles Of Financial Advisor Jobs 3 Easy Facts About Financial Advisor Job Description Shown

Saving you the hrs of work needed to load out such a lengthy tax obligation return, a good accounting professional can aid you save money on tax obligations by making smart choices throughout the year. And also for tiny organization proprietors, an accountant is essential to help you remain on top of such matters as staff member pay-roll, organization deductions, and also quarterly tax obligation filings.

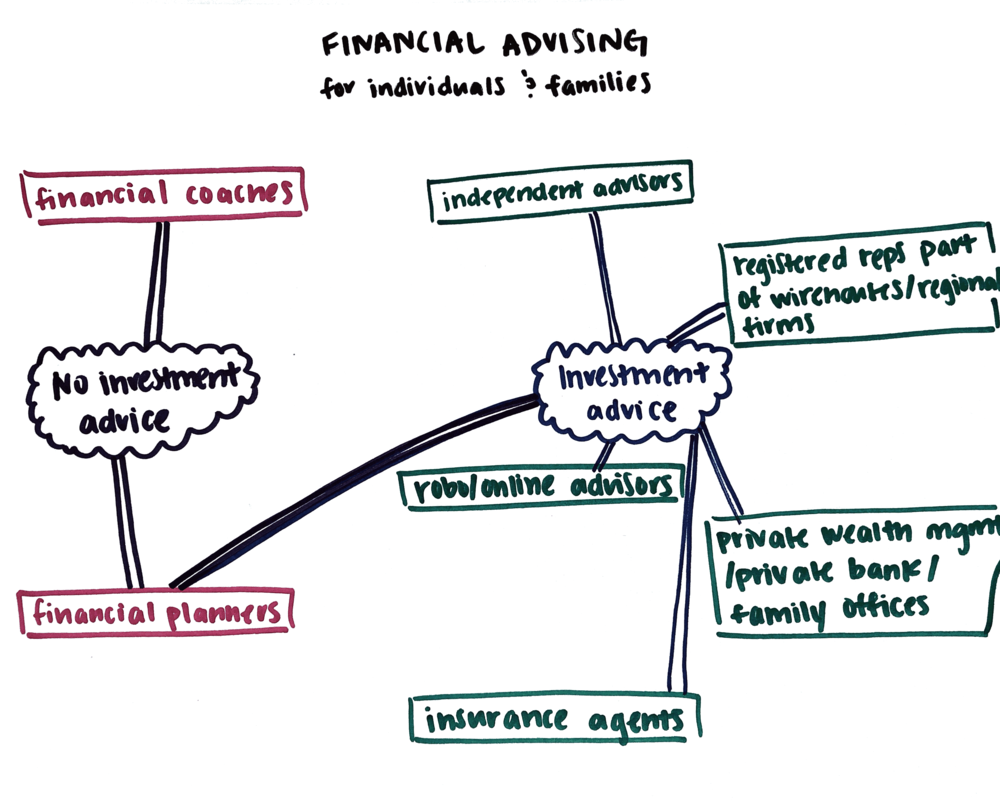

Insurance coverage representatives make their money offering insurance policies, yet that's not all they do. Due to the fact that they understand all the ins and outs of the insurance policy organization, they can inform you about the various sorts of insurance policy as well as what you need based on your scenario. Some insurance coverage agents can likewise assist you contrast policies from various companies to locate the finest offer.

Financial Advisor Definition for Dummies

These economic pros make their cash from the insurance provider. Some help simply one firm and also gain a wage; others function individually as well as gain their money from payments on the sales they make. The disadvantage of this is that your insurance representative isn't truly functioning for you. They're making money to offer policies the larger the policy, the much better.Exactly how to Make a decision if You Need One In the past, if you needed insurance coverage, going to a representative was the only way to get it. Nowadays, nonetheless, it's feasible to purchase insurance coverage directly online. You can conveniently check out the sites of different firms to get quotes as well as compare them to see which provides the most effective price.

Shopping directly is practical, as well as it's sometimes feasible to discover a lower rate this way. When insurance provider offer their policies via an agent, they need to pay that individual a compensation, which additional price gets factored into the rate. When you go shopping straight, there's no commission, and in some cases those savings are passed on to you.

The Basic Principles Of Financial Advisor Definition

For one, a local insurance coverage representative will know your area, so if you have a claim, the agent might be able to suggest a regional automobile body shop for any type of solutions you may require. Agents can additionally approve cash settlements something a website can't do. And many individuals merely appreciate the personal touch of being able to speak with a representative in person and also have their inquiries responded to.These agents market plans from a range of carriers, so they can assist you compare prices and also pick the plan that's the very best suitable for you. Restricted representatives, by contrast, market policies from only one company. The most effective means to find a good insurance coverage agent is to ask for referrals.

Lawyer You may not believe of a lawyer as a monetary expert. Many people's images of attorneys are possibly restricted to the ones they see on TV: mainly court room legal representatives protecting criminals.

Financial Advisor - An Overview

Legal, Zoom says that if you desire added estate preparation services together with your will, such as a power of lawyer, you can expect to pay around $1,000 if you're solitary. For married pairs who require joint documents, the expense is concerning $1,500. A living trust fund is a fund that holds assets and passes them on your successors after your fatality.Nolo says establishing one up prices a minimum of $1,200 to $1,500, while Legal, Zoom places the price between $1,000 as well as $2,500. You can likewise complete this through for just $399. In some states, you're called for by law to have a Learn More lawyer supervise the closing on a home purchase. In others, it's up to you whether to employ a lawyer.

Not known Facts About Financial Advisor Job Description

For instance, if you require assistance with estate preparation, find a lawyer who's an expert in estate legislation. Hiring a separation attorney to write your will is like hiring a plumbing to re-shape your house it's simply not the same capability. To find the kind of attorney you require, begin by requesting for referrals from friends and family.Make sure the attorney is certified to financial advisor bdo practice in your state as well as is trained in the area you require assistance with.

And if you have a specific monetary requirement that asks for a professional, such as an attorney, your monetary planner can aid you locate one. How Much They Price Financial planners are often paid by the hr. Hourly rates typically vary from $150 to $300, according to Rock Tips Financial.

A Biased View of Financial Advisor Certifications

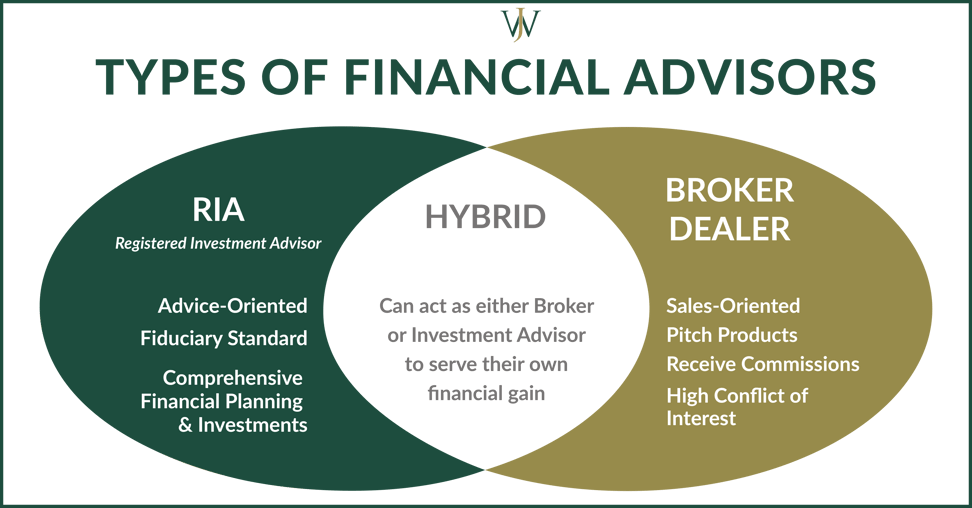

Individuals with this title have actually finished an extensive training course in finance as well as passed a collection of exams dealing with topics like insurance coverage and also estate preparation. CFPs are additionally fiduciaries, which implies they're legally obliged to act in your finest monetary passions, even if they make less cash by doing this. There are likewise competent financial coordinators with various titles.Hiring a PFS might make good sense if you require aid with tax obligations or various other bookkeeping needs particularly. The very best monetary coordinator for you is one who deals with clients whose demands are comparable to your very own. Ask around for references from various other individuals who are in the exact same economic scenario as you, such as little organization owners or new moms and dads.

Just How Much They Expense Some financial investment experts are "fee-only," which means they make all their money directly from you. They can bill a per hour price, however extra commonly, their cost is based on the quantity of the possessions they're managing for you. financial advisor near me. As an example, if you visit this page have a profile worth $250,000, you may pay a consultant 1% of that, or $2,500 per year, to manage it for you.

The Buzz on Financial Advisor Definition

You can pay reduced costs with this kind of consultant, but there's a disadvantage: They have a motivation to offer you items you do not need simply to gain the compensation. Exactly how to Determine if You Need One The more cash you need to take care of, the extra you need to gain by making sure it's handled well.People and also firms birthing this title are signed up with the Stocks Exchange Payment (SEC) and also are legally bound to function as fiduciaries. You can discover one by searching the SEC internet site. has a helpful tool where you can answer a few questions and also they will match you with three potential economic experts so you can determine who would be the best fit (Financial advisor).

You pay a certain quantity monthly to the therapist, and also they distribute the cash to your lenders. Sometimes, when the counselor establishes the DMP, they can work out with your creditors to obtain you a reduced interest rate or waive penalties for previous late payments. Just How Much They Price The expense of financial obligation therapy depends upon what kind of service you use.

Financial Advisor Certifications Fundamentals Explained

If you enroll in a DMP, you will always need to pay a fee despite having a nonprofit firm. Usually, there is a single fee for establishing the DMP, which is generally in between $25 and $75. You have to pay a regular monthly cost for the solution, which depends on the amount of your debt and the number of creditors you have.How to Make a decision If You Need One Certainly, you just need financial debt counseling if you have financial obligation. It also needs to be an amount of financial debt that you can not easily handle by yourself, and a sort of debt that a credit report therapist can assist with. Here are a few means to tell if debt therapy is an excellent suggestion for you:.

According to experts, if your DTI is listed below 15%, your debt is at a workable degree. If it's any greater than that, that's a sign that you're a good prospect for credit scores counseling.

A Biased View of Advisors Financial Asheboro Nc

When you discover a company that looks reasonable, start asking concerns - Financial advisor. Locate out what solutions it uses, whether it's accredited to exercise in your state, as well as what certifications their members have. If you require to deal with a certain kind of financial obligation, such as home mortgages, trainee finances, or clinical costs, you can look for an agency that specializes in this location.Report this wiki page